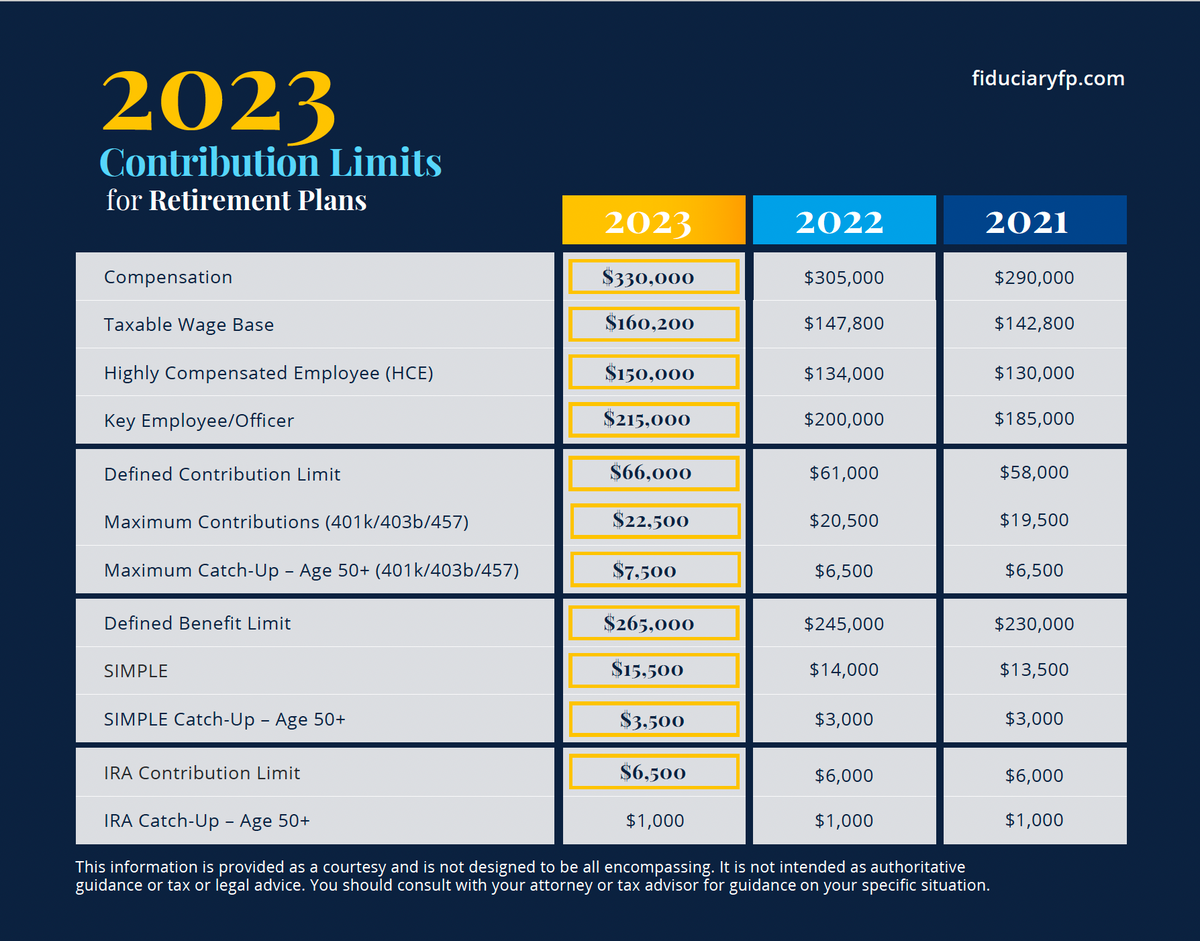

Maximum 403b Contribution 2025 Over 50. The irs elective contribution limit to a 403 (b) for 2025 starts at $23000. The internal revenue service recently announced the annual 403 (b) limits for 2025.

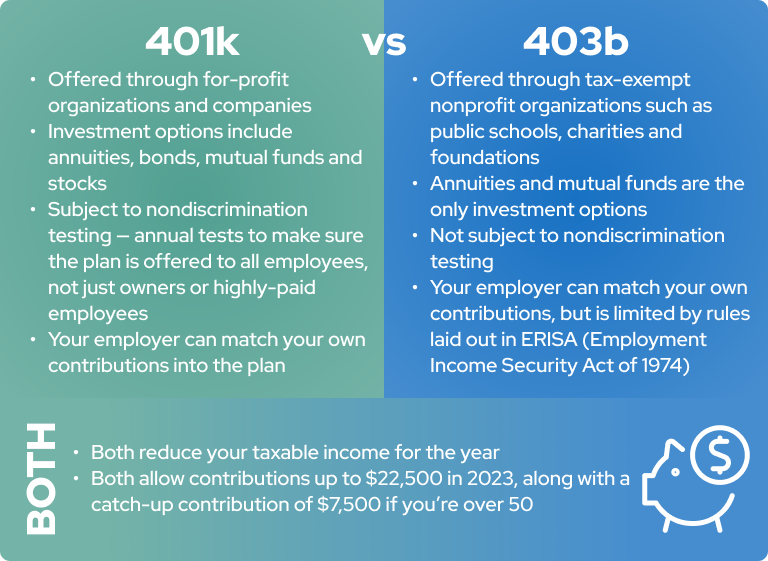

403(b) Contribution Limits for 2025, In 2025, 403(b) contribution limits are set at $22,500. Distributions for emergency personal expenses.

2025 403b Limit Jane Roanna, If permitted by the 403 (b) plan, employees who are age 50 or over at the end of the calendar year can also make catch. Discretionary or matching contributions from employers are permitted, up to a total combined maximum of $69,000 in employer and employee contributions for those younger than 50 in 2025.

2025 Ira Contribution Limits Over 50 EE2022, The annual 403 (b) contribution limit for 2025 has changed from 2025. For 2025, the limit on annual additions has increased from $66,000 to $69,000.

403b 2025 Limits Aeriel Charita, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2025. For 2025, the limit on annual additions has increased from $66,000 to $69,000.

403(b) Retirement Plans TaxSheltered Annuity Plans, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2025. The irs elective contribution limit to a 403 (b) for 2025 starts at $23000.

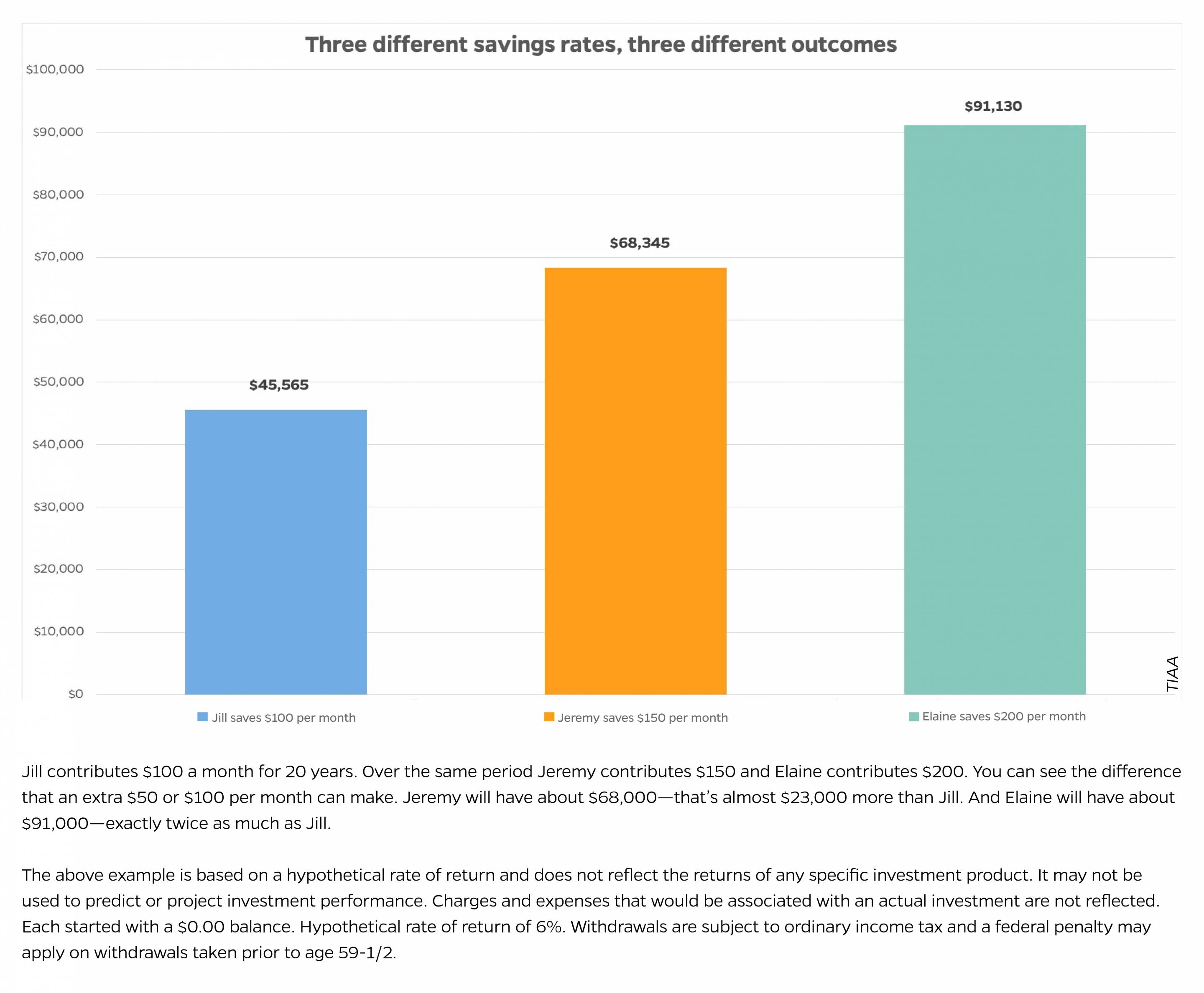

Business Concept Meaning 403b Maximum Contribution with Phrase on the, The extra $500 amounts to about $23 per. The maximum 403(b) for employees over 50 is $30,500 in 2025.

Making voluntary contributions to your 403(b) retirement plan Hub, As of 2025, the employer is allowed to contribute 25% of an employee’s income up to a maximum amount of $69,000. Potentially, depends on income and.

Roth Contribution Limits 2025 Caril Cortney, The internal revenue service recently announced the annual 403 (b) limits for 2025. Distributions for emergency personal expenses.

403(b) Contribution Limits For 2025 And 2025, If permitted by the 403 (b) plan, employees who are age 50 or over at the end of the calendar year can also make catch. Like 401 (k) plans, 403 (b) plans allow participants to set aside money for.

401K Limits 2025 Stefa Emmalynn, Under the 2025 limits, the 403 (b) retirement plan maximum contribution, as an elective deferral, is $23,000. If you're over 50, you can save $30,500 per year, or a.

DIY Tutorials WordPress Theme By WP Elemento